Now Reading: Architects of Financial Safety – The Actuarial Vision

-

01

Architects of Financial Safety – The Actuarial Vision

Architects of Financial Safety – The Actuarial Vision

Actuaries: Architects of Financial Safety Nets

Actuaries are expert professionals who blend mathematics, statistics, and financial theory to anticipate and manage risk. In industries such as insurance, pensions, and healthcare, they serve as strategic protectors of long-term financial stability. By quantifying uncertainty, actuaries build resilient financial frameworks that help society face the future with confidence.

copyright by Kalanidhivapinews.com

Risk Begins With Clarity

The first task of an actuary is to define the exact risk scenario—whether it’s the chance of a natural disaster, a health crisis, or pension insolvency. Clear problem definition is the cornerstone of building any effective financial defense mechanism.

copyright by Kalanidhivapinews.com

Every Insight Begins With Data

Actuaries gather large sets of historical and real-time data, cleaning and validating it for accuracy. This data serves as the foundation for uncovering trends and developing predictive insights that guide crucial decisions.

copyright by Kalanidhivapinews.com

Numbers That Speak: Analyzing Risk with Precision

Through deep statistical analysis and segmentation, actuaries uncover patterns, correlations, and anomalies. These insights allow organizations to understand the subtle forces shaping outcomes—and adjust strategies proactively.

copyright by Kalanidhivapinews.com

The Blueprint of the Future: Mathematical Models

Actuaries construct sophisticated mathematical models—from regression equations to Monte Carlo simulations—to estimate the probability and cost of future events. These models are tested, refined, and validated continuously to mirror reality.

copyright by Kalanidhivapinews.com

Risk, Quantified and Qualified

Using these models, actuaries quantify risk exposure, evaluate financial consequences, and perform scenario analysis to simulate unexpected variables—like regulatory shifts or market crashes.

copyright by Kalanidhivapinews.com

Strategizing for Stability

The insights derived from risk assessment feed into solution design—be it insurance pricing, pension planning, or investment strategies. Actuaries create sustainable financial products that strike a balance between safety and profitability.

copyright by Kalanidhivapinews.com

Translating Complexity into Clarity

An actuary’s responsibility extends beyond analysis—they must communicate technical outcomes clearly to decision-makers, enabling informed policy, pricing, or strategic direction.

copyright by Kalanidhivapinews.com

⸻

Ongoing Vigilance: Review and Refine

Risk is dynamic, and actuaries know this well. They continuously monitor real-world outcomes, compare them with predictions, and recalibrate their models to ensure long-term alignment with evolving realities.

copyright by Kalanidhivapinews.com

Guardians of Financial Systems

Actuaries keep insurers, governments, and corporations prepared for the unknown—ensuring payouts, reserves, and guarantees remain intact during financial turbulence.

copyright by Kalanidhivapinews.com

Ethics Meets Equity

By pricing products fairly and transparently, actuaries promote social fairness, protect consumers, and uphold the integrity of financial ecosystems.

copyright by Kalanidhivapinews.com

Planning the Unpredictable

Through scenario modeling and stress testing, actuaries help businesses plan for black swan events—from pandemics to natural disasters—creating operational continuity strategies.

copyright by Kalanidhivapinews.com

Intuition Backed by Evidence

An actuary balances logic and judgment—relying on data but also using professional wisdom to adjust for market sentiment, regulatory ambiguity, and societal behavior.

copyright by Kalanidhivapinews.com

Financial Visionaries Behind the Curtain

Though rarely in the spotlight, actuaries shape billion-dollar decisions, influence public policy, and engineer products that millions depend on daily.

copyright by Kalanidhivapinews.com

Future-Proofing Institutions

From climate risk analysis to AI-driven forecasting, actuaries are constantly evolving their toolkits to keep institutions agile and future-ready.

copyright by Kalanidhivapinews.com

Not Just Insurance: Actuaries Across Industries

Actuarial science applies to healthcare systems, climate resilience planning, banking stress tests, and employee benefit forecasting—anywhere uncertainty intersects with finance.

copyright by Kalanidhivapinews.com

Guardians of Retirement Futures

Actuaries design pension plans to ensure that individuals and governments can meet long-term financial commitments decades into the future.

copyright by Kalanidhivapinews.com

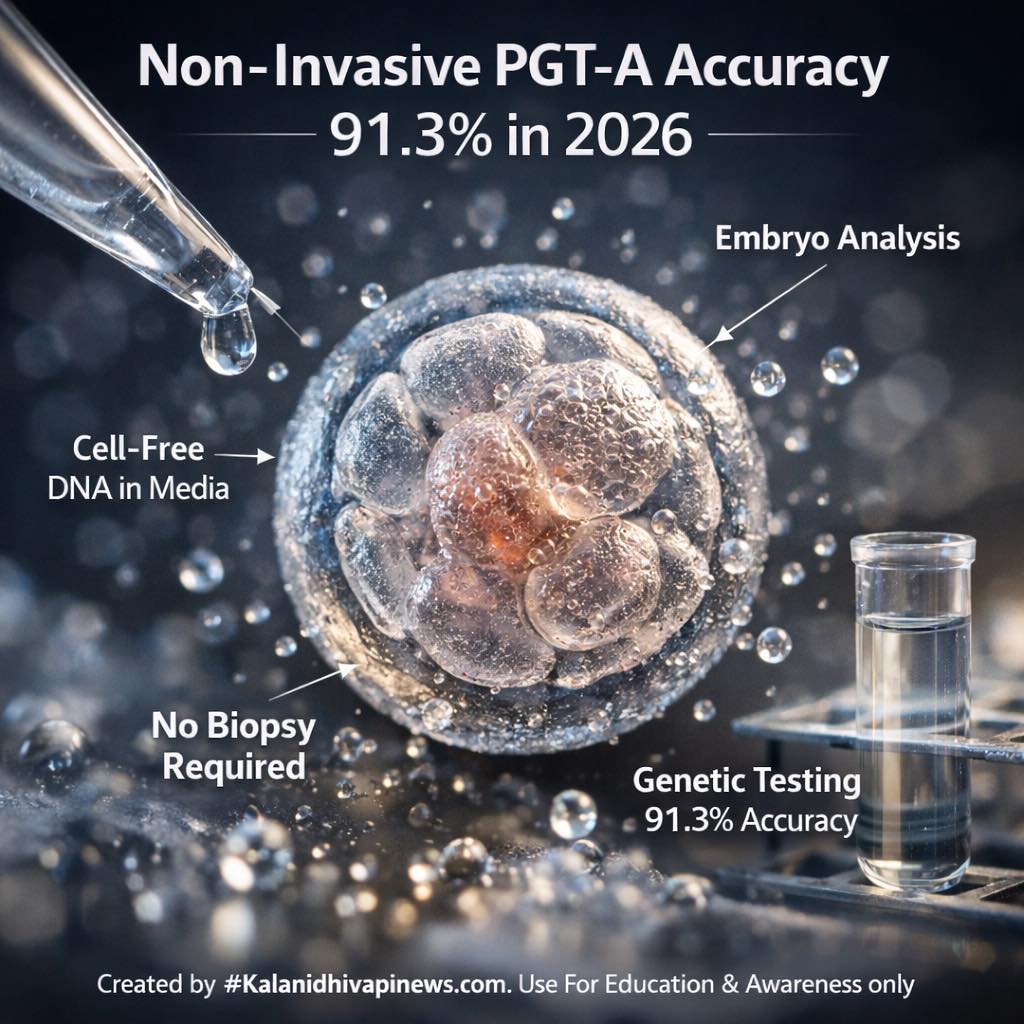

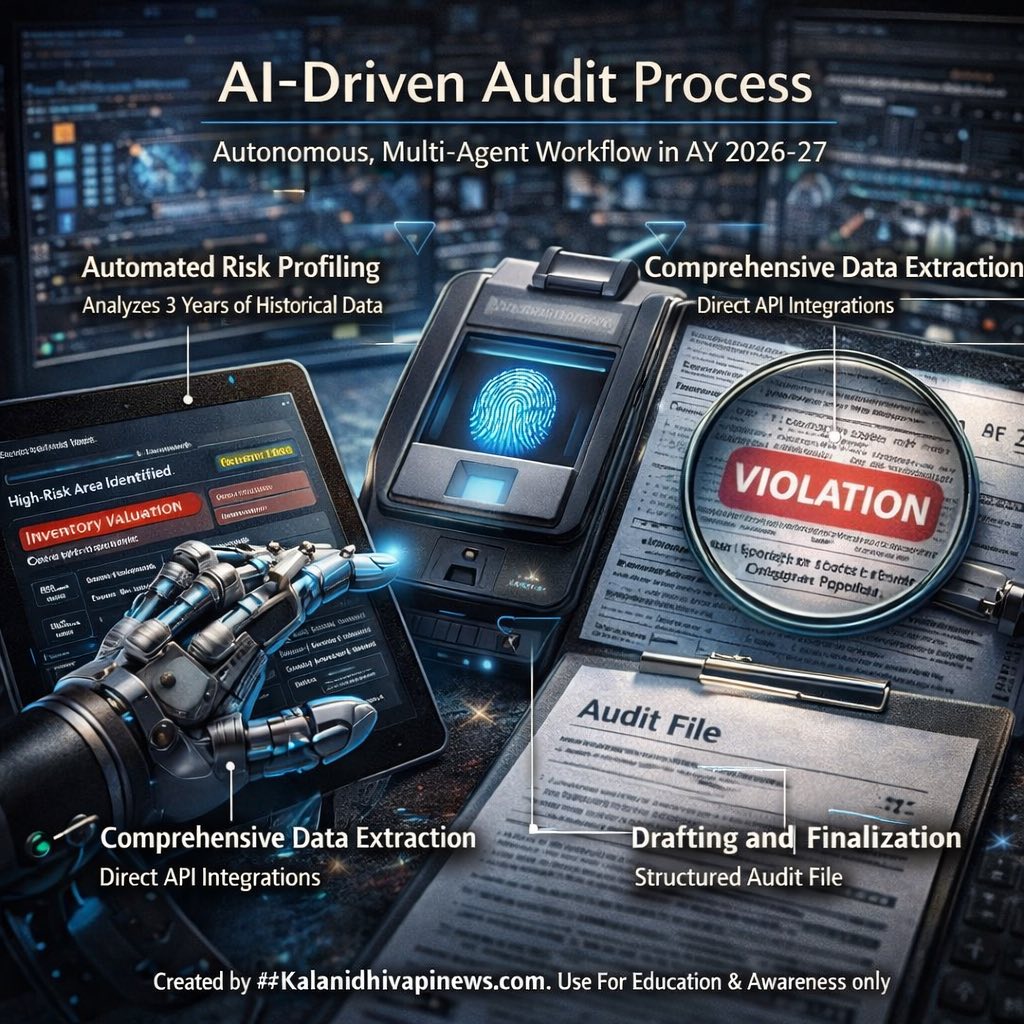

AI + Actuarial: Smart Risk Solutions

Modern actuaries leverage artificial intelligence, machine learning, and real-time data streams to refine predictions, detect fraud, and streamline underwriting.

copyright by Kalanidhivapinews.com

Global Standards, Local Impact

With certifications from bodies like the Society of Actuaries (SOA) or Institute of Actuaries of India (IAI), actuaries work under rigorous ethical and professional standards worldwide.

copyright by Kalanidhivapinews.com

The Financial Sentinels of Society

In turbulent economic times, actuaries play a critical stabilizing role, ensuring reserves, reinsurance, and solvency margins are well maintained.

copyright by Kalanidhivapinews.com

1. #FSci – Financial Science: The analytical field that actuaries are part of.

2. #RiskMod – Risk Modeling: Building tools to estimate future outcomes.

3. #DataIQ – Data Intelligence Quotient: Expertise in data analysis.

4. #ActLife – Actuary Life: Professional journey of actuaries.

5. #Quantify – Make Measurable: Turning risk into numbers.

6. #RiskAware – Conscious of Uncertainty: Actuaries enable foresight.

7. #StatCrack – Statistical Mastery: Breaking data into insights.

8. #ModelMind – Predictive Thinking: Building future-focused models.

9. #ScenarioLab – Test Futures: Simulating what-if cases.

10. #PremiumLogic – Fair Pricing: How insurance costs are calculated.

11. #PensionSafe – Retirement Assurance: Designing safe pension plans.

12. #RiskRadar – Early Warning Systems: Continuous monitoring.

13. #ActuTech – Tech in Actuarial Science: AI, software, models.

14. #StabilityMap – Path to Resilience: Forecasting economic impact.

15. #ReguAlign – Regulatory Alignment: Meeting compliance standards.

16. #EthicalPrice – Fair Market Value: Socially responsible pricing.

17. #RiskNudge – Behavior & Risk: Human psychology meets numbers.

18. #SecureNow – Present Protection: Risk strategy for today.

19. #FutureReady – Anticipating Change: Long-term preparedness.

20. #SafeGrid – Safety Net Design: Societal protection systems.

21. #StatSeg – Segmented Analysis: Fine-tuned demographic study.

22. #CommuClarity – Clear Communication: Simplifying complexity.

23. #AssumpCheck – Model Testing: Validating predictions.

24. #FinEthos – Ethics in Finance: Acting responsibly.

25. #BridgeBuild – Linking Now to Later: Strategic transitions.

26. #MacroMic – Macro to Micro Risk: Scalable forecasting.

27. #InsureSure – Insurance Reliability: Robust product design.

28. #PolicyPulse – Track Policy Impact: Actuarial reviews.

29. #SmartCalc – Advanced Computation: Algorithms + human insight.

30. #TrustMath – Mathematics of Trust: Public confidence in