Now Reading: AI Powering the Future of Tax, Audit, and Compliance

-

01

AI Powering the Future of Tax, Audit, and Compliance

AI Powering the Future of Tax, Audit, and Compliance

“AI Unmasks Tax Frauds Across Gujarat”

Copyright: www.kalanidhivapinews.com

India’s Income Tax Department is rewriting the playbook for fraud detection by leveraging cutting-edge AI technology. By analyzing millions of financial records, third-party datasets, and return filings, AI pinpoints suspicious deductions and irregular refund claims with unparalleled accuracy. In Gujarat—covering cities like Ahmedabad, Surat, Rajkot, and Vapi—AI-driven raids and investigations have dismantled organized rackets exploiting fake House Rent Allowance (HRA), education loan deductions, and other tax exemptions. Over 40,000 taxpayers have voluntarily withdrawn fraudulent claims worth ₹1,045 crore in just four months. This tech-powered crackdown not only brings offenders to justice but also strengthens public trust in financial systems by ensuring fair tax practices.

“EY’s $1B AI Leap to Free Accountants from Routine”

Copyright: www.kalanidhivapinews.com

Ernst & Young (EY) is transforming the accounting landscape by investing $1 billion in AI-powered agents through its EY.ai platform, developed in collaboration with Nvidia. These smart agents automate tedious accounting tasks—ranging from tax processing and audits to compliance workflows—allowing professionals to focus on complex and strategic work. With operations spanning the US, India, and other global markets, EY aims to mitigate talent shortages and reduce burnout, while boosting efficiency across its teams. This AI-driven approach not only enhances productivity but also paves the way for a future where accountants become advisors and innovators, rather than being bogged down by repetitive drudgery.

“RSM’s $1B AI Push for Smarter Tax & Compliance”

Copyright: www.kalanidhivapinews.com

RSM US is redefining middle-market tax and compliance processes with its $1 billion AI investment. Central to this transformation is RSM Atlas, a generative AI tool that streamlines complex regulatory workflows, automates routine tasks, and ensures precision in compliance. Early implementations have delivered remarkable results—up to 80% efficiency gains—by cutting down manual work and enhancing accuracy. This initiative not only drives significant cost savings for clients but also allows RSM professionals to focus on strategic advisory roles, setting a new benchmark for AI adoption in the financial services sector.

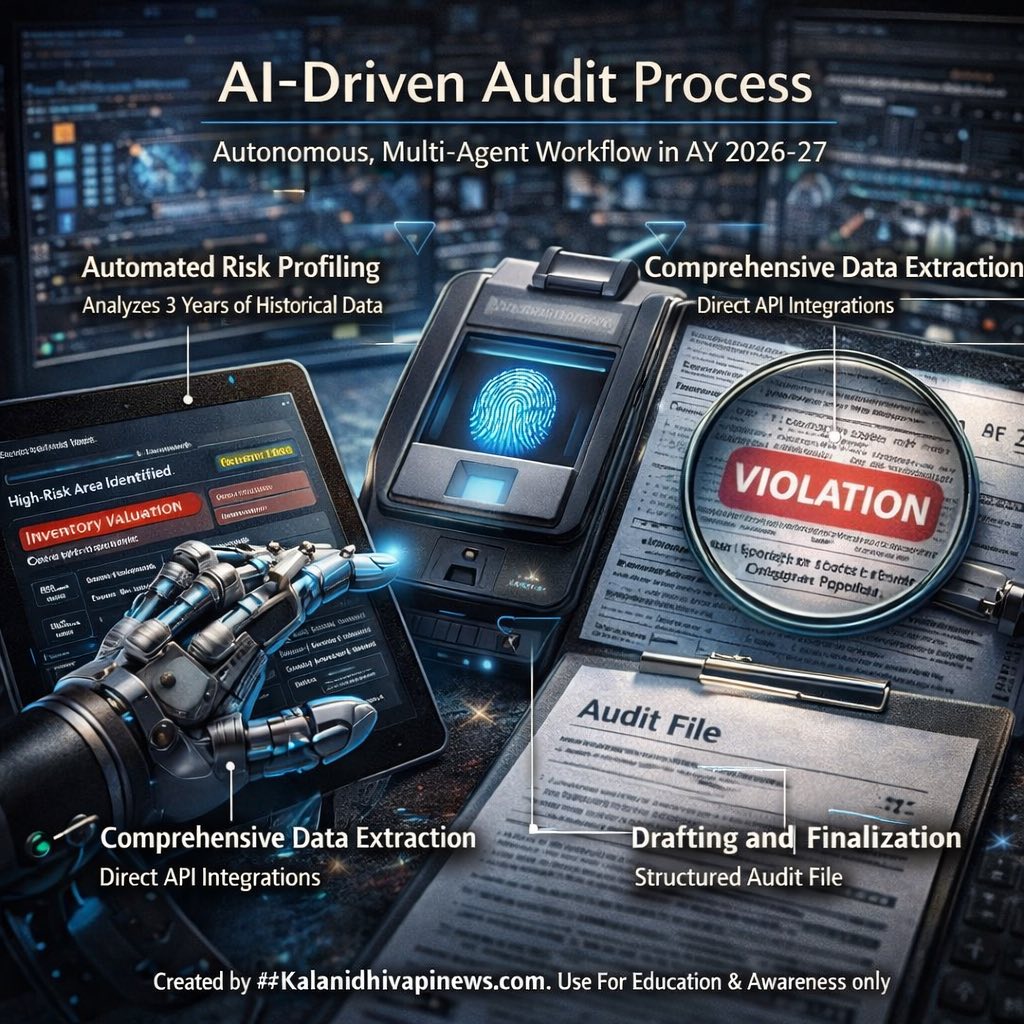

“Big Four Lead the AI Revolution in Tax & Audit”

Copyright: www.kalanidhivapinews.com

The Big Four—Deloitte, EY, PwC, and KPMG—are ushering in a new era of automation by embracing “Agentic AI,” a cutting-edge technology that enables autonomous tax and audit operations. These AI agents are capable of independently analyzing documents, identifying risks, and interacting with clients, transforming how compliance and audits are performed. With solutions like Deloitte’s “Zora” and EY’s EY.ai, the firms are setting new industry benchmarks in efficiency and service delivery. This shift marks a paradigm change, moving from traditional manual oversight to intelligent, self-operating audit ecosystems that redefine productivity and reliability in financial services.

“PairD Chatbot Revolutionizes Deloitte UK Audits”

Copyright: www.kalanidhivapinews.com

Deloitte UK is rapidly expanding the use of its AI chatbot “PairD,” with 75% of auditors now engaging with the tool at least once a month—up from just 25% previously. PairD’s capabilities include document summarization, code support, and advanced data analysis, streamlining traditionally complex tasks. With over 1.1 million chatbot prompts issued so far, the AI assistant is significantly improving audit quality, accelerating workflows, and providing a real-time learning aid for junior staff. This move signals Deloitte’s shift toward AI-driven auditing, setting new benchmarks in both efficiency and accuracy.

“ICAI Empowers Future CAs with AI and CA-GPT”

Copyright: www.kalanidhivapinews.com

The Institute of Chartered Accountants of India (ICAI) is taking a bold step to future-proof its members by launching a specialized AI curriculum and “CA-GPT,” an advanced AI training tool. With a vision to prepare 5 million AI-skilled Chartered Accountants by 2050, ICAI is embedding cutting-edge AI learning in its professional training. This initiative aims to ensure that India remains at the forefront of the global accounting profession, with professionals equipped to handle the demands of an AI-driven economy. By merging technology with financial expertise, ICAI is creating a future-ready workforce that can drive innovation and support India’s ambitious economic goals.

1. #AI – Artificial Intelligence: Technology simulating human intelligence.

2. #Automation – Use of technology to perform tasks with minimal human input.

3. #FinTech – Financial Technology: Innovations enhancing financial services.

4. #TaxTech – Technology transforming tax processes and compliance.

5. #AuditAI – AI-powered auditing processes.

6. #Compliance – Adherence to laws, regulations, and standards.

7. #BigFour – Refers to Deloitte, EY, PwC, and KPMG.

8. #AgenticAI – AI agents that work autonomously with decision-making abilities.

9. #RSM – RSM International, a global network of audit, tax, and consulting firms.

10. #EYai – Ernst & Young’s AI-powered business platform.

11. #Deloitte – A leading multinational professional services firm.

12. #PwC – PricewaterhouseCoopers, one of the Big Four.

13. #KPMG – Klynveld Peat Marwick Goerdeler, a Big Four firm.

14. #PairD – Deloitte UK’s AI chatbot used for auditing tasks.

15. #ICAI – Institute of Chartered Accountants of India.

16. #CAGPT – AI-powered learning platform launched by ICAI.

17. #Accounting – The process of managing financial records and reporting.

18. #Auditing – Examining financial records for accuracy and compliance.

19. #Taxation – The practice and study of tax policies and management.

20. #AITraining – Programs and tools designed to teach AI applications.

21. #GenerativeAI – AI that creates new content like text, images, or code.

22. #DigitalTransformation – Integration of digital technologies into business operations.

23. #Efficiency – Achieving maximum productivity with minimal waste.

24. #Innovation – Developing new methods, ideas, or technologies.

25. #FutureOfWork – The evolving landscape of jobs and industries due to technology.

26. #AIinFinance – Use of AI to optimize financial tasks and services.

27. #DataAnalytics – Analysis of data to gain insights and support decision-making.

28. #GlobalMarkets – Worldwide financial and economic systems.

29. #TechLeadership – Leading industries through technological advancements.

30. #EconomicGrowth – The increase of wealth, services, and productivity in an economy.