Now Reading: Statutory Precision to Autonomous Compliance

-

01

Statutory Precision to Autonomous Compliance

Statutory Precision to Autonomous Compliance

Section 44AB mandates compulsory tax audit for specified taxpayers to ensure correctness of income and compliance. It applies to manufacturing companies exceeding prescribed turnover limits. This provision strengthens transparency and standardizes financial reporting. It also forms the legal base for balance sheet verification.

Glossary: Section 44AB – Provision under Income Tax Act requiring mandatory tax audit.

created by @kalanidhivapinews.com for awareness only

⸻

Turnover represents the total value of sales generated during a financial year. It determines whether tax audit applicability is triggered. Manufacturing entities rely on accurate turnover reporting for compliance. Misstatement can attract penalties and scrutiny.

Glossary: Turnover – Gross revenue from business operations.

created by @kalanidhivapinews.com for awareness only

⸻

Digital transactions refer to payments made through electronic modes. High digital usage allows higher audit threshold benefits. It encourages transparency and traceability in business dealings. Manufacturing companies benefit from reduced compliance burden.

Glossary: Digital Transactions – Non-cash electronic payment methods.

created by @kalanidhivapinews.com for awareness only

⸻

Form 3CA is used when accounts are audited under other laws. It certifies that statutory audit has been conducted. The form links financial statements with tax audit reporting. Accuracy here ensures legal validity.

Glossary: Form 3CA – Tax audit report form for audited entities.

created by @kalanidhivapinews.com for awareness only

⸻

Form 3CD provides detailed tax-related disclosures. It includes clauses on depreciation, TDS, and compliance checks. Manufacturing companies disclose operational specifics here. It supports risk-based assessments.

Glossary: Form 3CD – Statement of particulars annexed to tax audit report.

created by @kalanidhivapinews.com for awareness only

⸻

Audit threshold defines the revenue limit for mandatory audit. It varies based on transaction mode. Crossing the limit invokes statutory obligations. Proper monitoring avoids non-compliance.

Glossary: Audit Threshold – Turnover limit triggering tax audit.

created by @kalanidhivapinews.com for awareness only

⸻

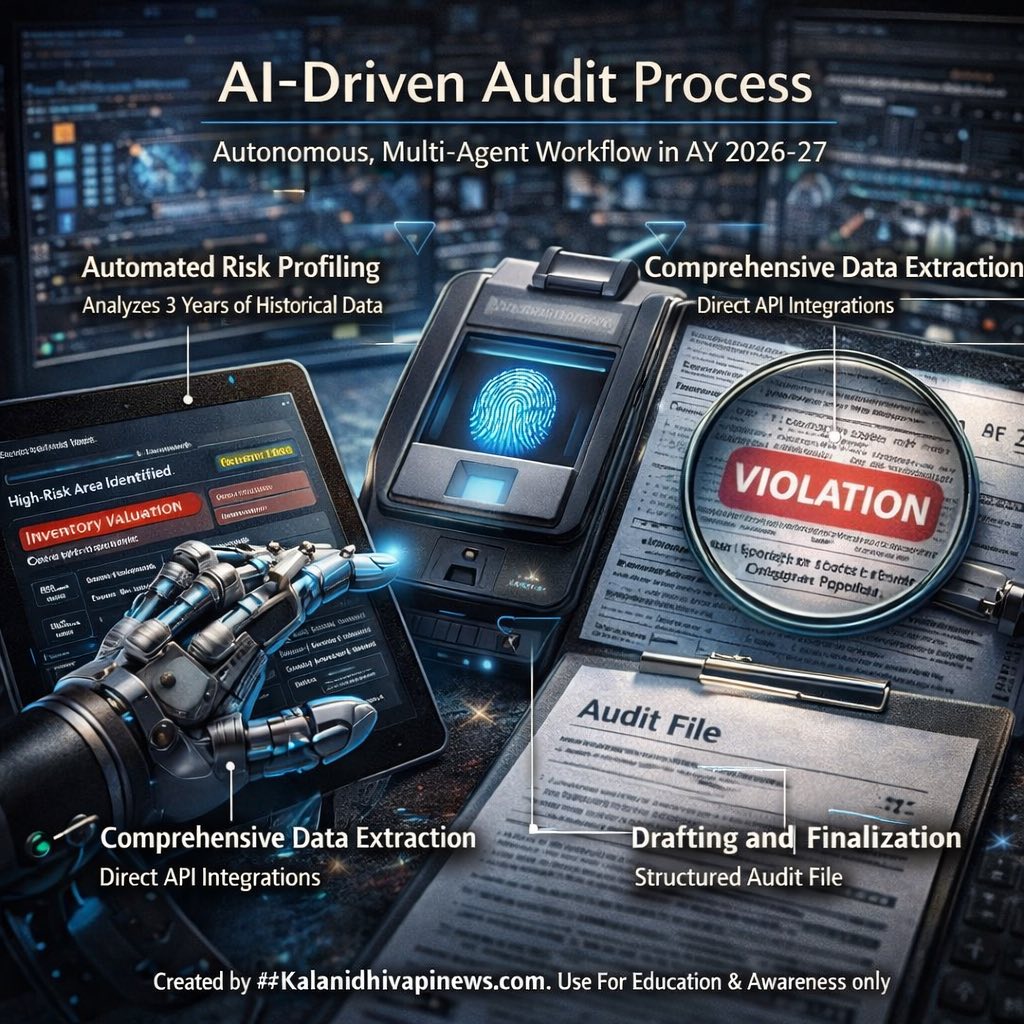

Assessment Year is the year in which income is assessed to tax. AY 2026-27 corresponds to FY 2025-26. All compliance timelines align with this period. Errors impact tax determinations.

Glossary: Assessment Year – Year following financial year for tax assessment.

created by @kalanidhivapinews.com for awareness only

⸻

Manufacturing involves conversion of raw materials into finished goods. It carries complex cost and inventory structures. Audits focus heavily on valuation accuracy. Regulatory compliance is industry-sensitive.

Glossary: Manufacturing – Industrial production of goods.

created by @kalanidhivapinews.com for awareness only

⸻

Inventory valuation determines cost of unsold goods. It directly affects profit reporting. Errors may distort taxable income. Audits emphasize method consistency.

Glossary: Inventory Valuation – Measurement of inventory value in accounts.

created by @kalanidhivapinews.com for awareness only

⸻

Revenue recognition defines when income is recorded. Manufacturing contracts require careful timing. Incorrect recognition can misstate profits. Compliance ensures faithful representation.

Glossary: Revenue Recognition – Accounting principle for recording revenue.

created by @kalanidhivapinews.com for awareness only

⸻

Risk profiling identifies areas prone to misstatement. It uses historical and industry data. High-risk zones receive deeper scrutiny. This improves audit efficiency.

Glossary: Risk Profiling – Process of identifying audit risk areas.

created by @kalanidhivapinews.com for awareness only

⸻

ICFR ensures controls over financial reporting. It validates process reliability. Manufacturing operations rely on strong ICFR. Weak controls raise compliance risks.

Glossary: ICFR – Internal Control over Financial Reporting.

created by @kalanidhivapinews.com for awareness only

⸻

Compliance means adherence to statutory provisions. It reduces litigation exposure. Manufacturing entities face multi-law compliance. Proper audits reinforce discipline.

Glossary: Compliance – Conformity with legal requirements.

created by @kalanidhivapinews.com for awareness only

⸻

Audit report communicates verified findings. It provides assurance to tax authorities. Accuracy impacts acceptance of returns. It is a legal document.

Glossary: Audit Report – Formal opinion on financial statements.

created by @kalanidhivapinews.com for awareness only

⸻

Timeline defines statutory deadlines. Tax audit reports precede return filing. Missing deadlines attracts penalties. Planning ensures smooth compliance.

Glossary: Timeline – Prescribed schedule for compliance actions.

created by @kalanidhivapinews.com for awareness only

⸻

September 30 is the common tax audit due date. It marks completion of reporting. Delays invite interest and penalties. Adherence is critical.

Glossary: September 30 – Statutory tax audit filing deadline.

created by @kalanidhivapinews.com for awareness only

⸻

Data extraction pulls information from systems. It ensures completeness of records. Manufacturing data spans multiple platforms. Accuracy supports audit integrity.

Glossary: Data Extraction – Retrieval of structured financial data.

created by @kalanidhivapinews.com for awareness only

⸻

AIS consolidates taxpayer financial information. It aids cross-verification. Discrepancies trigger queries. Alignment ensures smooth assessment.

Glossary: AIS – Annual Information Statement.

created by @kalanidhivapinews.com for awareness only

⸻

TIS summarizes transactional data. It complements AIS for analysis. Audits reconcile books with TIS. Mismatches indicate risk.

Glossary: TIS – Taxpayer Information Summary.

created by @kalanidhivapinews.com for awareness only

⸻

Control testing evaluates effectiveness of processes. It ensures transactions are authorized. Manufacturing cycles require continuous checks. Results guide audit conclusions.

Glossary: Control Testing – Examination of internal controls.

created by @kalanidhivapinews.com for awareness only

⸻

Continuous audit involves ongoing verification. It replaces periodic sampling. Manufacturing operations benefit from early detection. Compliance becomes proactive.

Glossary: Continuous Audit – Real-time audit approach.

created by @kalanidhivapinews.com for awareness only

⸻

KYC verifies identity and authenticity. It prevents duplicate or fake records. Audits flag identical documentation. Strong KYC supports compliance.

Glossary: KYC – Know Your Customer verification process.

created by @kalanidhivapinews.com for awareness only

⸻

Working papers document audit procedures. They support conclusions drawn. Regulatory reviews rely on them. Proper documentation ensures defensibility.

Glossary: Working Papers – Audit evidence documentation.

created by @kalanidhivapinews.com for awareness only

⸻

NFRA oversees audit quality standards. It reviews compliance of auditors. Manufacturing audits fall under its scope. Quality lapses invite action.

Glossary: NFRA – National Financial Reporting Authority.

created by @kalanidhivapinews.com for awareness only

⸻

IT assessment evaluates taxable income. It relies on audited data. Discrepancies may lead to additions. Accurate audits reduce disputes.

Glossary: IT Assessment – Income tax scrutiny process.

created by @kalanidhivapinews.com for awareness only

⸻

Balance sheet reflects financial position. It includes assets and liabilities. Manufacturing entities hold significant inventories. Accuracy is legally critical.

Glossary: Balance Sheet – Statement of financial position.

created by @kalanidhivapinews.com for awareness only

⸻

Shadow agent prevention ensures system integrity. It avoids unauthorized interventions. Audit trails remain intact. Legal reliability is preserved.

Glossary: Shadow Agent – Unauthorized parallel process risk.

created by @kalanidhivapinews.com for awareness only

⸻

#DataLineage

Data lineage tracks origin of information. It ensures traceability of figures. Audits depend on clear lineage. It strengthens evidentiary value.

Glossary: Data Lineage – Tracking data source and flow.

created by @kalanidhivapinews.com for awareness only

⸻

#StatutoryAudit

Statutory audit is mandated by law. It validates financial statements. Manufacturing companies must comply annually. It underpins tax governance.

Glossary: Statutory Audit – Legally required audit of accounts.

created by @kalanidhivapinews.com for awareness only